|

|

|

|

| Article / Finance / Stock Market | Post Comments |

IPO Investment and Its Impact On Investors Portfolio |

|

| By : Seema Gurnani , Hyderabad, Andhra Pradesh, India 19.5.2018 Mail Now | |

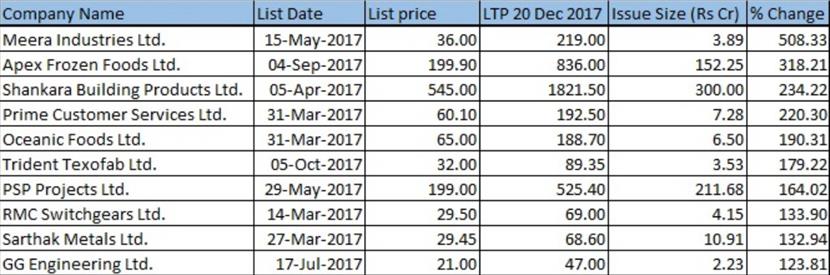

In the year 2017, a number of IPOs or Initial Public Offers has reaped huge

profit over the issue price for their investors. This probability of making huge

profit has attracted many investors in year 2018, to invest more in IPO. Many

new traders have gained the interest and started researching about the IPOs from

the scratch. If you are a beginner in this field, then reading this article can

provide you the real insight about the notion of investment in IPOs over the

regular stocks. Below are the listed IPOs that has given 100% to 500% return to

its investors.  Initial public offering or the IPO: When the private company offers the stock to the public for the first time. IPOs are often offered by smaller or younger companies who are seeking for capital for the company's growth and expansion. IPOs are also offered by large companies so that their stocks can be traded publicly in an easy way. Sometimes few companies are willing to release IPOs for the prepayment or repayment of debts. Many people think that investing in IPOs is risky. But there is always a great chance of high returns with high risk. So before any kind of investment in IPO, the investor must give a thought on the following points and must dig deep about the company overview and its financials. This research will always help the investors to isolate the best IPO for investment. Don't be in hurry to buy IPO of any Company Every year, more than hundreds of IPOs are released by small, medium and large companies. So it is always better to wait for the best IPOs that can give maximum return on investment. You can always keep a track on the Upcoming IPOs every month and get to know about the companies offering IPO. In order to save time and do proper research about the IPOs, always read the reviews on the IPO from various reviewing website and subscribe if necessary, to get the latest updates. There are always potential risks as well as rewards associated with every IPO. So take your time, research and investigate well about the company's overview and financial profile. Understand the risk before investing your money that what are the possibilities and probability to lose. Things to check before IPO investment: - Try to understand WHY the company is releasing the IPO. Many companies don't reveal the REAL objective behind any IPO. - How the company makes money and how much the company can raise money through this IPO. - What are the key products and services company provide. - About the History of the company, Quality of Management, Financial statement, etc. - Whether the key members of the company are experienced enough to secure the future of the company. Important Points to consider in IPO: |

|